We have spoken and written often about the perils of market timing and the damage that it can do to investor returns. As laid out, the argument against market timing is simple: it is hard on the way in and hard on the way out. But the cyclical forces that make market timing hard do not blow equally across industries. There are parts of the economy that are less affected and parts that are more affected by sharp inflections in growth. The industries that are more affected and the reasons for our general avoidance of them is the subject of this newsletter.

The first point of discussion is what exactly makes market timing difficult. Market timing, as it applies to long-only investing, is the activity of purchasing the shares of a company before a positive inflection in the business and then selling the shares of the same company before the inevitable negative inflection. This requires not one, but two decisions: when to buy and when to sell. The issue is that these inflections occur in a largely unpredictable fashion and when they do occur, they do so with changing intensity and duration, making their forecasting practically impossible.1 This is important as it means that it is not obvious whether future periods will see rising or falling revenue. This, in turn, is important because many fixed costs are incurred whether a business generates revenue or not and the downswing of operating leverage can compress profits. If the growth of earnings is the main driver of share price growth over time, this is a dynamic that we should pay close attention to.

Cyclicality and Industries

Why do some companies experience greater cyclicality than others? A clue is in the way that their businesses are organised. At its most basic, there are companies that benefit more from economic growth and companies that benefit less. Sometimes this is because they are closer to the coal face. Sometimes it is because they are able to exploit the supply-demand equation for a time. Sometimes they are simply lucky. In all cases, economics works for these companies until it doesn’t and eventually all cycles sow the seeds for their own demise.

The companies with the greatest exposure to this cyclical swinging are businesses in sectors of the economy that amplify GDP growth. These businesses often, but not always, boom and bust with the economic cycle in a pro-cyclical way. Investing in these businesses at the wrong point in the cycle is a recipe for capital destruction. It is like buying a ticket for a concert and arriving for the encore – you might get a classic, but you have almost certainly missed the best music.

At Seilern, we do not have a great deal of exposure to pro-cyclical companies (and sectors for that matter) but this is not because we have some inherent dislike for all cyclical companies. Our bar, as always, is the Ten Golden Rules and most cyclicals offend one or more of them.

Cyclicality and the Ten Golden Rules

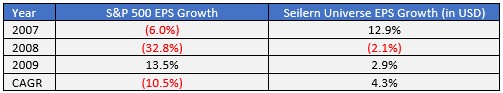

Our first Golden Rule is superior industry growth. The key ingredient here is at least one growth driver that is independent of the economy (though our companies often have more than one). This growth driver is like a parachute, softening the crash when the cycle reverses. Seilern Universe companies have these in spades (an ageing population, the shift to cashless payments and the digitalisation of industry to name a few) that have had the practical effect of supporting sales growth when the broader economy contracts. How much support? Quite a bit – while the global economy shrank by -0.1 per cent during the great financial crisis of 2007-2009, companies in the Seilern Universe compounded earnings by 4.3 per cent (Table 1). As you can see from Table 1, the broader market was not as fortunate, declining -10.5 per cent.

Table 1: Earnings Growth of the S&P 500 compared to the Seilern Universe

Source: Seilern Investment Management Ltd., Factset

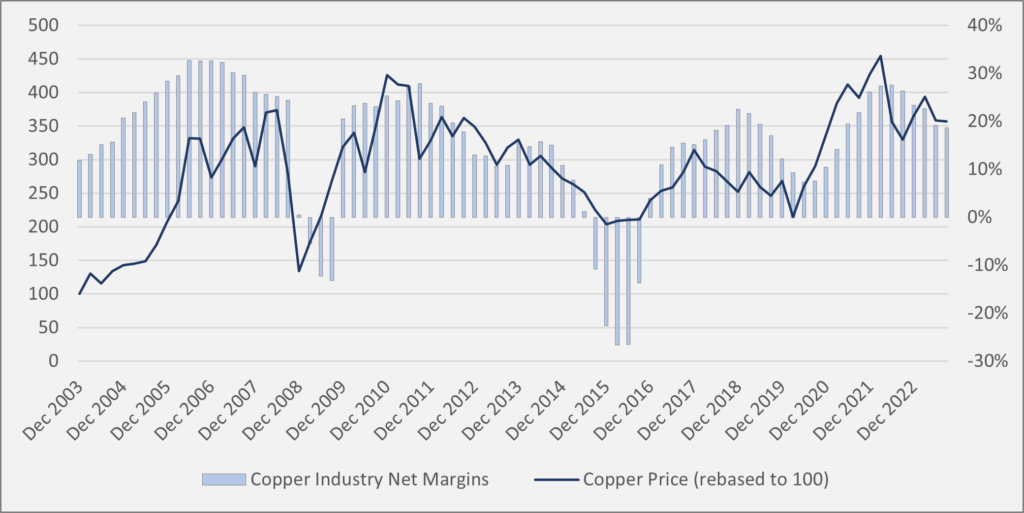

Next, cyclical companies are usually price takers, meaning they lack control over their revenue. While pricing power is not a rule in and of itself, it is central to our fifth Golden Rule to have strong organic growth. This lack of pricing power presents a growth challenge when supply outstrips demand for the product or service that they sell. When this happens, the price of the product will adjust to match the new equilibrium and in many cases the revenue will fall in sympathy. When combined with high operating leverage, profits can be crushed. A neat illustration of this is the copper industry, whose revenue and profits were dictated essentially by the exposure of global growth to China. The copper bosses reaped great profits on the upswing, but as expected, their profitability collapsed when the price of copper fell (Figure 1).

Figure 1: Swings & Roundabouts – the profitability of copper companies is driven by its price2

Source: FactSet, Company Reports, 31 December 2022

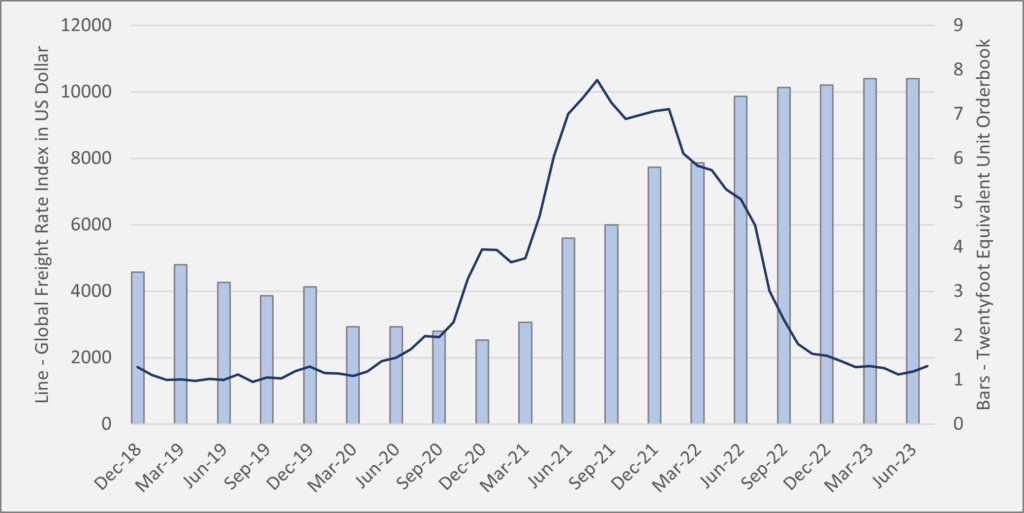

Cyclical companies also often have a high level of capital intensity. Out of the gate this offends our seventh Golden Rule which calls for businesses to have low capital intensity. At Seilern, we prefer businesses that do not require a large amount of capital to generate sales (the best businesses can do the same with less, or more with the same). Equally as bad as having high capital intensity, cyclical companies often have a relatively poor record of deploying that capital, putting a great deal of it to work at or near the peak of the cycle. The global shipping industry is an archetype of this behaviour with the major shipping companies investing in capacity at the peak of the cycle almost as a rule,3 unbalancing the equilibrium and destroying the profitability of the industry.

Figure 2: Drewry Global Freight Rate Index vs Twenty-foot Equivalent Unit orderbook

Source: Drewry, Clarkson Shipping Intelligence, 30 June 2023

Such is the frequency of this practice that it begs investigation. Surely nobody makes the same mistake over and over again? The reality has an important lesson for the investor.

Cyclicality and Capital Allocation Decisions

All companies have a number of choices to make with respect to capital allocation. Broadly speaking, they can invest in their own business, acquire other businesses, pay down debt or distribute the cash to the owners.4 A business with a stable growth driver has the luxury of being able to forecast costs and revenue with some level of accuracy. Capital allocation decisions, in turn, can be made to sync up with these growth expectations with relatively low risk that spending plans are left stranded by revenue that does not materialise.

A cyclical business has no such luxury. This makes the capital allocation challenge even more difficult, particularly with respect to whether or not to invest in growth capex. It becomes a game theory conundrum – risk not investing in the business at a peak in the cycle and competition may steal market share or invest in the business at a peak in the cycle and run the risk of damaging future growth by drastically increasing supply at the wrong time. In addition, where demand is highly variable, the money may not be there tomorrow and investors in the West are generally not fans of running inefficient balance sheets.

These issues on their own are enough to worry about. However, when cyclical companies are combined with high levels of debt the effects can be catastrophic, as my colleague Corentin touched upon in his newsletter last month. Our view is that these problems are best avoided entirely.

Just because businesses in these cyclical industries are difficult to invest in, an investor might fairly argue that this, on its own, is not a good enough reason to avoid them and miss out on the upside of a cyclical upswing. We disagree. Our counter is that we are very happy to be left behind rather than compromise on our framework because we are confident in the knowledge that over long time periods, our Quality Growth style of investment has proved to be superior.

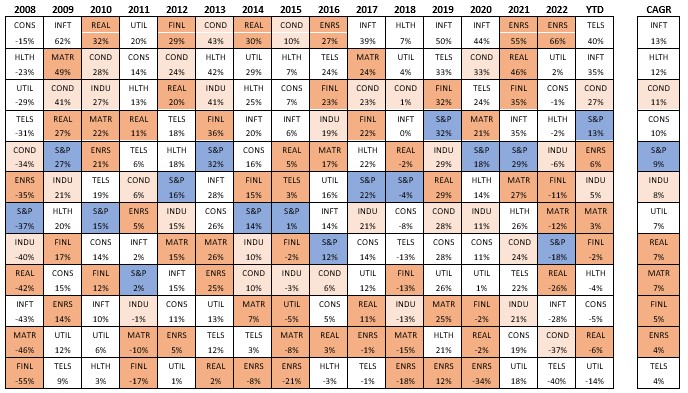

This is illustrated below in Table 2, which breaks out the highly-cyclical sectors (dark orange) from the mixed-cyclical sectors that contain both cyclical and non-cyclical companies (light orange) and the sectors that are dominated by non-cyclical companies (white). While in any given year, the cyclical sectors may swing from winner to loser, when performance is compounded over time, as is shown in the far-right column, cyclical companies are generally bad investments (the exceptions being parts of the consumer discretionary and industrial sectors that have structural growth drivers).

Table 2: Sector performance over time (2007-2023 YTD)

Source: S&P Global as at 30 September 2023

Market timing is difficult on its own, though making decisions on when to invest cannot be avoided. What can be avoided is exposing portfolios to the ebb and flow of highly cyclical businesses and what can be controlled is holding Quality Growth companies for long enough to allow the earnings to compound and drive share prices. Anything less is not good enough.

MJ Faherty

30 November 2023

Any forecasts, opinions, goals, strategies, outlooks and or estimates and expectations or other non-historical commentary contained herein or expressed in this document are based on current forecasts, opinions and or estimates and expectations only, and are considered “forward looking statements”. Forward-looking statements are subject to risks and uncertainties that may cause actual future results to be different from expectations. Nothing in this newsletter is a recommendation for a particular stock. The views, forecasts, opinions and or estimates and expectations expressed in this document are a reflection of Seilern Investment Management Ltd’s best judgment as of the date of this communication’s publication, and are subject to change. No responsibility or liability shall be accepted for amending, correcting, or updating any information or forecasts, opinions and or estimates and expectations contained herein.

Please be aware that past performance should not be seen as an indication of future performance. Any financial instrument included in this website could be considered high risk and investors may not get back all of their original investment. The value of any investments and or financial instruments included in this website and the income derived from them may fluctuate and you may not receive back the amount originally invested. In addition stock market fluctuations and currency movements may also affect the value of investments.

1Business textbooks will tell you that business cycles occur every 2-10 years. Very helpful indeed.

2Companies include Freeport-McMoRan, which along with Southern Copper is almost entirely a copper business. The other three companies are BHP, where copper makes up c.31 per cent of sales, Teck Resources (18 per cent) and Rio Tinto (11 per cent).

3It is slightly more complex than this. At the beginning of the cycle vessel earnings (charter rates) are low and in some cases, it is actually loss making for the shipping companies as there are too many ships and not enough cargo. As a result, owners start to send their old vessels for demolition, which is a more economical use. They also stop new orders and fleet growth overall halts or even reverses. Eventually, demand catches up with supply and as it reaches equilibrium any positive shock has large effects on earnings and vessel values. This causes a spike in rates which in turn causes the shipping companies to buy second-hand vessels and order new construction. Vessel orders increase due to the long lead times and across the board there is a scramble for capacity. Eventually this leads to an oversupply which pressures vessel earnings, driving them down and potentially loss-making, and the cycle starts again.

4Via share buybacks, a self-selecting method of distribution or dividends, a blanket method of distribution.

Get the latest insights & events direct to your inbox

"*" indicates required fields