We’re often asked where we find good companies. What is usually meant by this is where, in the economy, do we find good companies. But there is another way to think about the question, which examines the ‘where’ not in terms of economic sectors, but rather the company’s lifecycle.

S is for Sigmoid

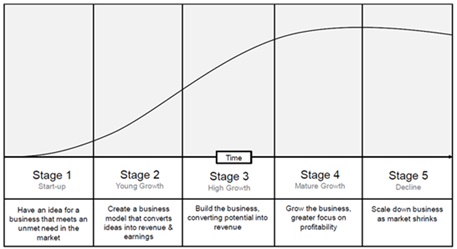

The starting point is to identify the different lifecycle stages and examine the attributes that businesses demonstrate at each stage. These stages are broken down on the following chart and overlaid with an s-curve (or sigmoid curve) to illustrate the growth and the level of risk in each stage.

Figure 1: The company lifecycle

At the earliest Start-up stage, the business is vulnerable. It may exist purely as an idea, scribbled on a napkin, or as a loss-making business that’s investing heavily in customer acquisition. Risk is high: 75 per cent of start-ups will not see their 15th birthday, and 90 per cent will not reach a mature stage of consistent profitability. Survival is exceptionally difficult. This is not a journey to take lightly or alone – almost all start-ups are financed by borrowing or giving away a stake in the business.

Investing in start-ups requires imagination and faith. It is best left to venture capitalists.

The next stage is Exponential Growth, where the goal is to grow quickly or, in the words of LinkedIn Founder Reed Hoffman, to ‘blitzscale’. These companies enjoy exponential growth and often see repeated and rapid doubling of their business. For them, the most important factor is the continuity of growth. Momentum and first-mover advantages are important; profitability is often a secondary concern.

This poses several problems. Firstly, it is hard to know what the future earnings profile of the business will look like. Secondly, it is impossible to value the business on a traditional profitability metric because there isn’t one, despite the inventive metrics conjured up by business analysts.

Investing in exponential growth businesses is like picking your racehorse for speed, before you’ve seen it jump a fence. Execution risks are high, and the breadth of outcomes (both upside and downside) is wide. It is a high-risk, high-return strategy.

Once the business has run the gauntlet of young growth, established a viable network and achieved the first benefits of scale, it reaches the High Growth phase. Here, sales are increasing, but the rate has declined from the dizzying prior stage. The company has proved its business model and cracked the formula for profitable growth. The strategic direction now shifts from pure growth to scaling the enterprise.

Most of our investments fall into this category and for good reason – growth is high and has proven sustainable. These businesses are the very definition of Quality Growth investing.

In the next Mature Growth stage, growth moderates, as the business settles into its strong competitive position, and margins expand. Towards the end of this stage, as the market becomes saturated or old, growth slows and the focus shifts from the top line to profits, often with disastrous consequences.

For companies here, a large improvement in profitability is not a welcome development but a sign that the business is squeezing the last drops from a slowing market. For the quality growth investor, it’s a signal that the business is approaching ex-growth and risks a material re-rating.

The last stage is Managed Decline. For these companies, sales growth has disappeared or gone negative. Their excellent profitability has attracted fierce competition, while business inertia has led to abandonment by capital markets, driving the stock price lower. This is the point in the lifecycle when many value investors invest, searching for businesses where they believe that the market has been unfairly harsh. This is a high-risk strategy. While value may be visible, the investor needs a catalyst to unlock that value.

R is for Risk

The reason the quality growth investor spends much time in the high-growth and mature-growth stages of a business is to manage risk. In a company’s early stages, there are significant uncertainties surrounding its viability or ability to generate consistent profitable growth. At the other end of the lifecycle, questions around the viability of the business arise again as it grapples with decline.

The quality growth investor is instead looking for businesses that can demonstrate growth in a sustainable and predictable way, and where the distribution of outcomes is narrowed to reflect the lower upside potential and lower downside risk.

1Of course, there is a great degree of overlap between the different stages and some stages last for much longer than others but as a generalised tool, the S-curve is very useful.

2Where the proportional increase in quantity is constant over time.

This is a marketing communication / financial promotion that is intended for information purposes only. Any forecasts, opinions, goals, strategies, outlooks and or estimates and expectations or other non-historical commentary contained herein or expressed in this document are based on current forecasts, opinions and or estimates and expectations only, and are considered “forward looking statements”. Forward-looking statements are subject to risks and uncertainties that may cause actual future results to be different from expectations.

Nothing contained herein is a recommendation or an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment advice. The content and any data services and information available from public sources used in the creation of this communication are believed to be reliable but no assurances or warranties are given. No responsibility or liability shall be accepted for amending, correcting, or updating any information contained herein.

Please be aware that past performance should not be seen as an indication of future performance. The value of any investments and or financial instruments included in this website and the income derived from them may fluctuate and investors may not receive back the amount originally invested. In addition, currency movements may also cause the value of investments to rise or fall.

This content is not intended for use by U.S. Persons. It may be used by branches or agencies of banks or insurance companies organised and/or regulated under U.S. federal or state law, acting on behalf of or distributing to non-U.S. Persons. This material must not be further distributed to clients of such branches or agencies or to the general public.

Get the latest insights & events direct to your inbox

"*" indicates required fields